The Foreclosure Process in 4 Simple Steps

Table of Content

BUT when the tenants have a month-to-month lease or the owner/landlord also lives in the home that is being foreclosed on, the new owner can evict the tenants or former owner/landlord. In these cases, the new owner may either offer the existing tenants a new lease or rental agreement or begin eviction proceedings. If the new owner chooses to evict existing tenants , the new owner must give the tenants at least 90 days’ notice before starting eviction proceedings. Clearly while the concept of foreclosure is straight forward, the path to its end can be complex. However, given that the rules for foreclosure are generally explicit and detailed under each state’s statutes, if a party has an experienced real estate attorney familiar with the process, the path can become much clearer. The sale may be postponed at the time and place originally set for the sale.

Home buyers are solely responsible for repaying mortgage debt obligations by end of the agreed upon loan term. This is when you have fallen behind on payments and the lender issues a notice of default . Short refinance—In a short refinance, the new loan amount is less than the outstanding balance, and the lender may forgive the difference to help the borrower avoid foreclosure. A foreclosure—the actual act of a lender seizing a property—is typically the final step after a lengthy pre-foreclosure process. Before foreclosure, the lender may offer several alternatives to avoid foreclosure, many of which can mediate a foreclosure’s negative consequences for both the buyer and the seller. If the mortgage remains delinquent after three to six months with no payments submitted, then the lender will officially begin foreclosure on the property.

What Is a Deed in Lieu of Foreclosure?

If the borrower is unable to make those missed payments, and the mortgage remains delinquent after three to six months, then the lender will officially begin the foreclosure process on the property. Sadly, the more time that a borrower has spent in delinquency without making any payments, the harder it is for them to catch up with the mortgage payments, making it overwhelmingly hard to stop the foreclosure process. A notice of default is sent after the fourth month of missed payments . This public notice gives the borrower 30 days to remedy past due payments before formally starting the foreclosure process. If the homeowner hasn’t come up with the money within 90 days of the notice of default, the lender may proceed with the foreclosure process.

A certificate of sale will identify the bidder, the sale amount and the bidder’s rights in the property. However, title may not transfer to the bidder until sale objections are resolved or, in states allowing redemption, until the redemption period has passed. The complaint sets forth the lender’s argument that it is entitled to the relief it seeks. Typically a complaint will include the mortgage, all loan documents, state the default and amount due, and identify the property. Some states require the lender to file an affidavit of fact with the complaint, which affidavit attests to the amounts due, the amount of the unpaid principal balance, unpaid interest due, late fees, attorney fees, and other costs. Further, a person with personal knowledge of the affidavit’s contents must sign it.

Other Loans & Products

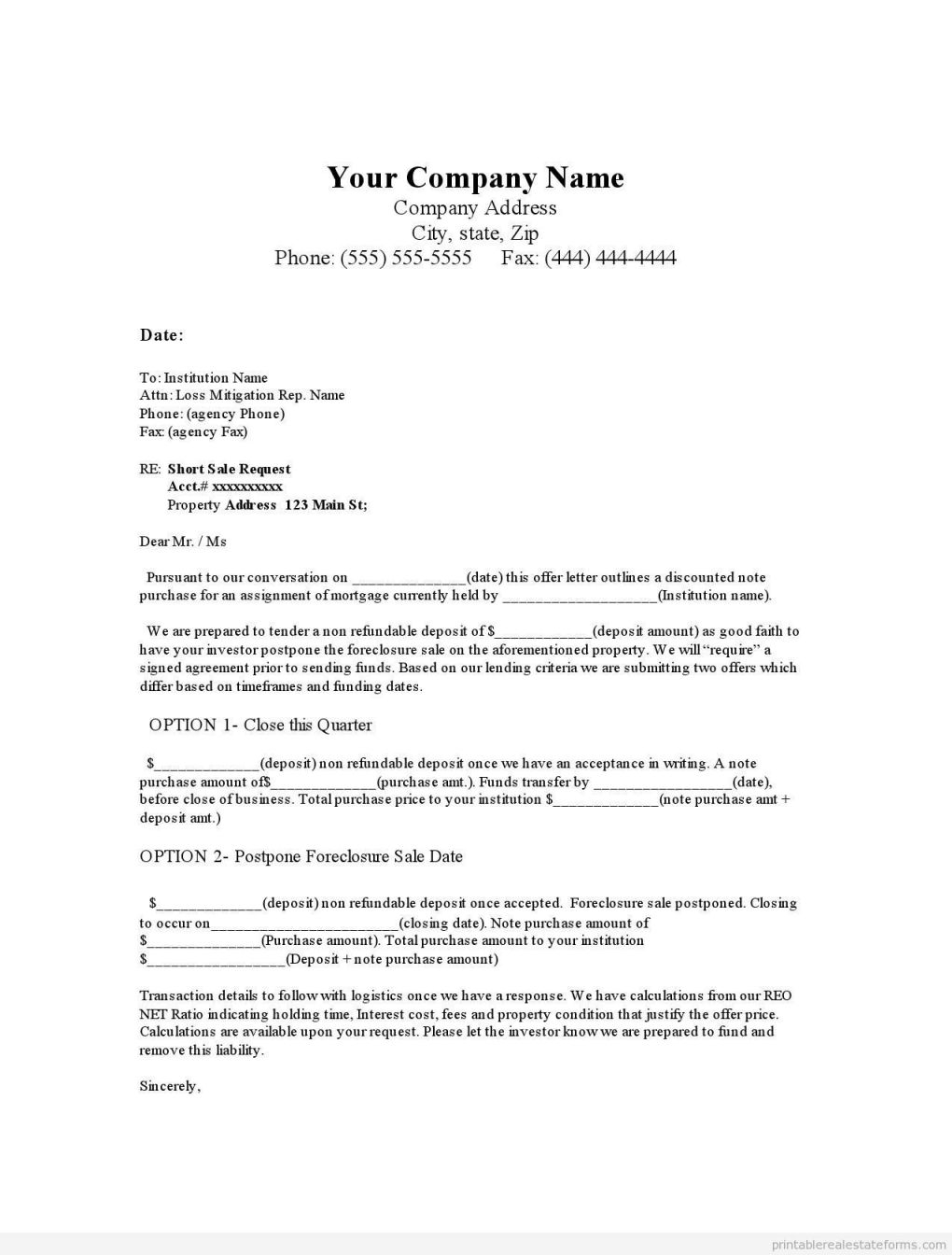

Then you will have to send the letter to the bank for the foreclosure. See the prepayment penalty or the foreclosure charges of the home loan. Borrowers have the option to prepay their Home Loan, by repaying the outstanding loan amount before the completion of the loan tenure. The Home Loan Foreclosure Calculator prevents you from taking hasty prepayment decisions, allowing you an insight into the repercussions of foreclosing your Home Loan. What’s more, you no longer have to rely on guesswork or manual calculations, as the calculator provides you with instant results based on the information submitted. The Home Loan Foreclosure Calculator allows borrowers to assess the savings they stand to make, with the current repayment conditions on their ongoing Home Loans in mind.

Foreclosure is the legal process by which a lender seizes and sells a home or property after a borrower is unable to meet their repayment obligation. If you know that you are going to have trouble making your mortgage payments, contact your lender immediately and let them know you are having financial difficulties. Remember, do not stop paying your bills, and do not wait until you cannot make payments before you act. A notice of sale is also sent via certified letter to the homeowner, but it also must be published weekly in a newspaper in the county where the home is located for three consecutive weeks before the auction date. This helps get the word out to potential buyers, but even at this late date, the option to reinstate your mortgage is still possible up until five days before the sale, so long as you can come up with the money.

Home Loan Foreclosure

The procedural requirements, including how quickly any of these actions must be taken, vary from state to state. In addition to the borrower, the new owner may need to deal with tenants remaining on the property. If the tenants were joined in the foreclosure action, the court may issue writs of possession to move the tenants out. In commercial cases, if the tenant’s lease included a subordination clause (meaning the tenant’s interest in the property is junior to the lender’s), the lender may terminate the lease and evict the tenant. Once the bidder is given ownership, the borrower either relinquishes possession of the property voluntarily or the bidder must bring an eviction lawsuit under state law. As noted above, in some states if the borrower refuses to transfer possession it may lose its right to redemption.

Scammers may offer to "help" you make your mortgage payments, but they’re just trying to take your money. Find out how to detect, report, and protect yourself against these scams. Termed a foreclosure avoidance assessment, this period might include requests for a payment adjustment, interest adjustment, deferral, or other accommodations. Here’s a look at the steps a homeowner will likely go through—plus some ways to get off this train and stop the foreclosure process from happening.

When an individual is not willing to pay further EMIs and wishes to pay off the home loan in full before the expiry of loan tenure then it is known as foreclosure of home loans. Foreclosure helps the individual to save interest on the remaining principal amount and he could invest that money somewhere else. Let’s see the fee charged by some banking and non-banking institutions when you foreclose a home loan.

Home Loan Pre-Closure can help borrowers save a significant amount of money through interest savings. But the option should be used carefully after considering the mortgage loan pre-closure charges and your current expenses. You can consult your lender to know more about loan prepayment and the exact amount you will be saving after deducting the penalty. Mortgages are loans that use real property as collateral against a borrowed sum of money. The amount generally correlates to the value of that property, and the borrower is allowed to live in the home so long as payments are made toward the principal loan amount, with interest.

Depending on the repayment period granted, the standard monthly mortgage payments become a little higher, and the homeowner gets a chance to make the mortgage current with much less damage to their credit. Even so, larger monthly mortgage payments may only make things worse for the homeowner, so this method is not really an option for some. That includes qualifying for a new home loan and being able to cover any closing costs required. If fear of foreclosure is the driving force behind a refinance decision, these things may already be out of reach. The lender will set a minimum bid, which takes into account the appraised value of the property, the remaining amount due on the mortgage, any other liens, and attorney fees.

There are typically six phases in the foreclosure process and the exact steps vary state by state. Once the home loan is paid off, it should reflect on your credit report. Repaying a loan can positively impact your credit line, so ensure the information is updated. Refinancing your mortgage allows you to pay off your existing mortgage and take out a new mortgage on new terms. You may want to refinance your mortgage to take advantage of lower interest rates, to change your type of mortgage, or for other reasons. Learn about your legitimate government-approved mortgage and foreclosure help options.

It is important to note that details of the pre-foreclosure and foreclosure process vary by state. In pre-foreclosure, a lender may present alternatives to foreclosure, including different attempts at mediation to negate any negative consequences towards both parties. However, it must be done after careful calculation, as sometimes it may very well be that you are not saving any money.

This is a saving grace for many home sellers in this position since investors who hunt for short sales are fairly easy to find. Regardless of how it may seem, foreclosure is not always beneficial for the lender. As a matter of fact, many lenders would rather try to keep the foreclosure process from happening at all. In many cases, lenders will instead opt to offer the borrower alternate means of resolving the issue instead of going through with the full foreclosure process.

Comments

Post a Comment