Arkansas Paycheck Calculator

Table of Content

Also, a bi-weekly payment frequency generates two more paychecks a year (26 compared to 24 for semi-monthly). While a person on a bi-weekly payment schedule will receive two paychecks for ten months out of the year, they will receive three paychecks for the remaining two months. Arkansas residents can tweak their paychecks in a few ways. One way to do this is to ask your employer to withhold a certain amount from each paycheck.

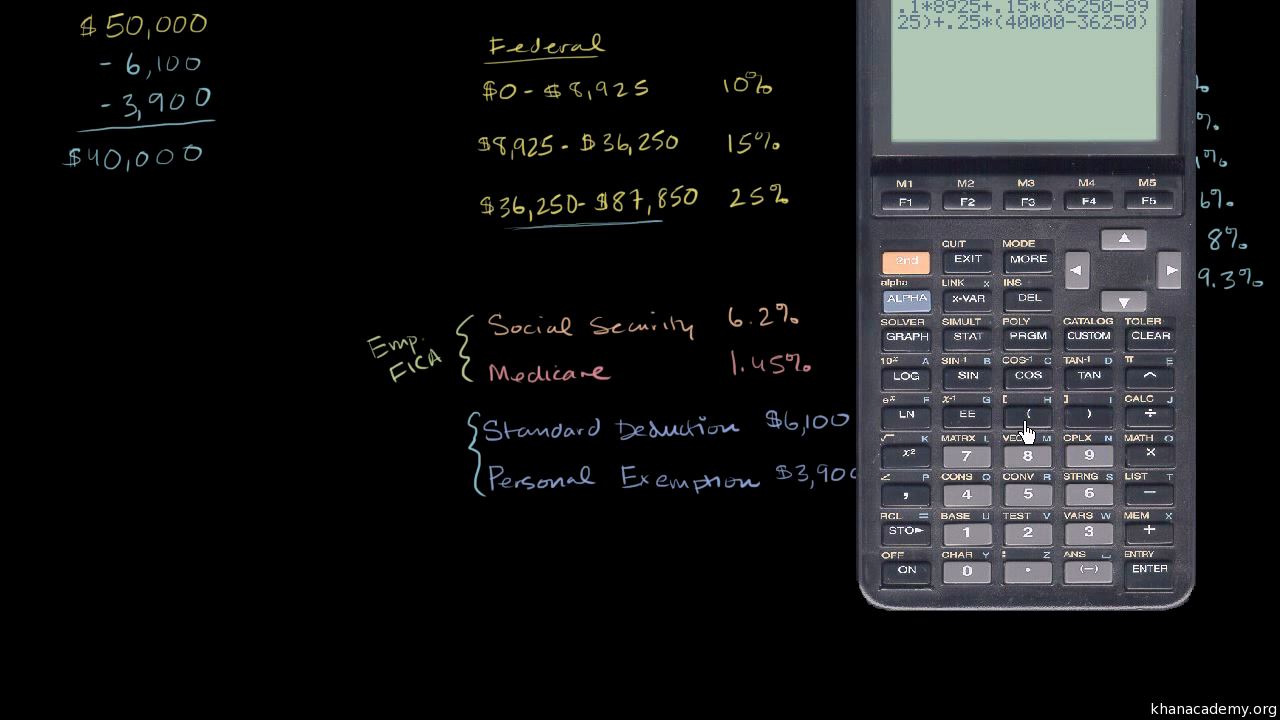

6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 ($160,200 for 2023). So any income you earn above that cap doesn’t have Social Security taxes withheld from it. In addition to income tax withholding, the other main federal component of your paycheck withholding is for FICA taxes. Your FICA taxes are your contribution to the Social Security and Medicare programs that you’ll have access to when you’re a senior.

Arkansas Gross-Up Calculator

Medicare is meant to supplement an employee’s healthcare benefits when they reach retirement age. Both employers and employees are required to contribute to Medicare at a rate of 1.45%. For employees, there is an additional 0.9% Medicare tax on wages earned after a $200,000 threshold.

There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.

Arkansas Income Tax Brackets and Other Information

Exemptions can be claimed for each taxpayer as well as dependents such as one’s spouse or children. Arkansas taxpayers pay some of the highest sales tax rates in the country, while also having some of the lowest property tax rates. Please keep in mind that these calculators are designed to provide general guidance and estimations. They are not official advice and do not represent any Netchex service. Please consult an accountant or invest in full-servicepayroll softwareto guarantee quick, automatic, and accurate payroll and tax services.

Picking the wrong filing status could cost you time and money. This Arkansas bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. The Arkansas bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. There are three tax brackets in the Sunflower State, with your state income tax rate depending on your income level.

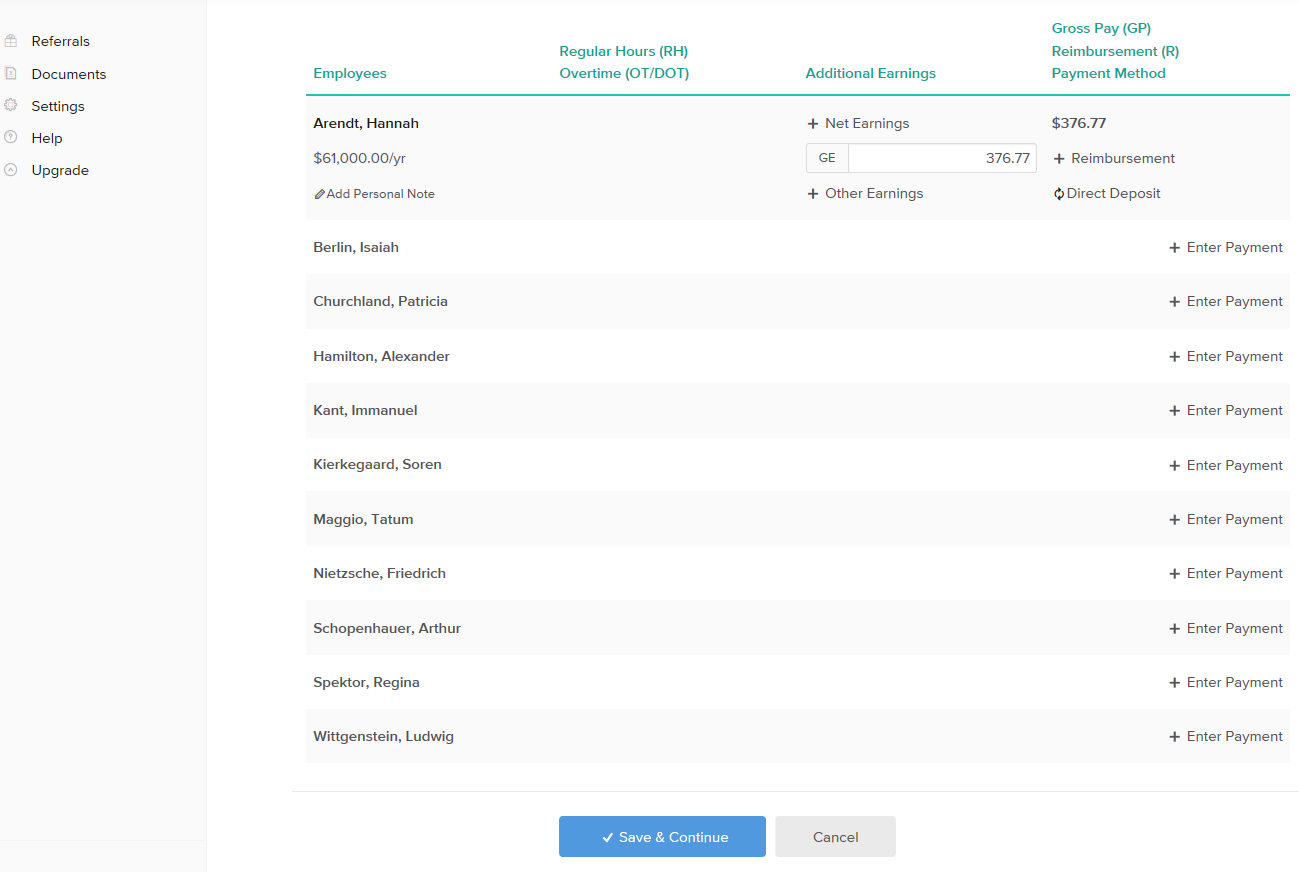

Self-service payroll for your small business.

Federal income tax and FICA tax withholding are mandatory, so there’s no way around them unless your earnings are very low. However, they’re not the only factors that count when calculating your paycheck. FICA contributions are shared between the employee and the employer.

There are many ways to increase the size of your paycheck, starting with asking for a raise or working additional hours, granted you are eligible for overtime. You can also shelter more of your money from taxes by increasing how much you put in a 401 or 403. Since this money comes out of your paycheck before taxes, you are lowering your taxable income and therefore saving yourself money.

While we try our best to stay up to date with changes in tax codes, we make no guarantee our salary calculator will be accurate. If you notice a major miscalculation or error with our salary calculator , feel free to direct message us on twitter and let us know. However, if you have specific tax questions, please consult a licensed tax professional. Additional careful considerations are needed to calculate taxes in multi-state scenarios. Learn more about multi-state payroll, nexus and reciprocity in this Multi-state Payroll guide.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but you’re more likely to get a tax refund and less likely to have tax liability when you fill out your tax return. One way to manage your tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven't had enough withheld to cover your tax liability for the year.

Arkansas has several sin taxes, including both a cigarette and alcoholic beverages tax. The alcohol tax varies depending on the variety and alcoholic content of the beverage. Distilled spirits, which have an alcoholic content of at least 40%, are taxed at a rate of $2.50 per gallon. Beer is taxed at a rate of $0.24 per gallon and wine is taxed at a rate of $0.75 per gallon. The assessed value of a homestead property, which is the value on which taxes are based, cannot increase by more than 5% in a single year. That ensures that homeowners are not caught off-guard by unexpectedly large tax bills.

In almost all cases, your employer will automatically withhold this amount from your paychecks and thus your take home pay should be around 0 per year or 0 per month. Note that this estimate is based only on the most common standard deductions and credits, if any. If you are eligible for additional deductions and credits, your taxes may differ. There are six personal income tax brackets that range from 0.9% to 7%. Use the Arkansas hourly paycheck calculator to see the impact of state personal income taxes on your paycheck. The federal income tax is a progressive tax, meaning it increases in accordance with the taxable amount.

Comments

Post a Comment